What Items Are Exempt From Sales Tax In Rhode Island . Web the human body are exempt from the rhode island sales and use tax. This exemption includes most grocery items. Web rhode island tax laws. How do i purchase my inventory of goods for resale without. Web in rhode island, certain food items are exempt from sales tax. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. All tangible products within rhode island are taxable. The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. (b) effective october 1, 2012, the exemption from. To help you determine whether you need to collect sales tax in rhode island, start by. Web the seller acts as a de facto collector. Web what if i have customers that are exempt from paying sales tax? Web what transactions are generally subject to sales tax in rhode island?

from www.templateroller.com

The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. Web rhode island tax laws. Web in rhode island, certain food items are exempt from sales tax. This exemption includes most grocery items. All tangible products within rhode island are taxable. Web the human body are exempt from the rhode island sales and use tax. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web what transactions are generally subject to sales tax in rhode island? How do i purchase my inventory of goods for resale without. Web what if i have customers that are exempt from paying sales tax?

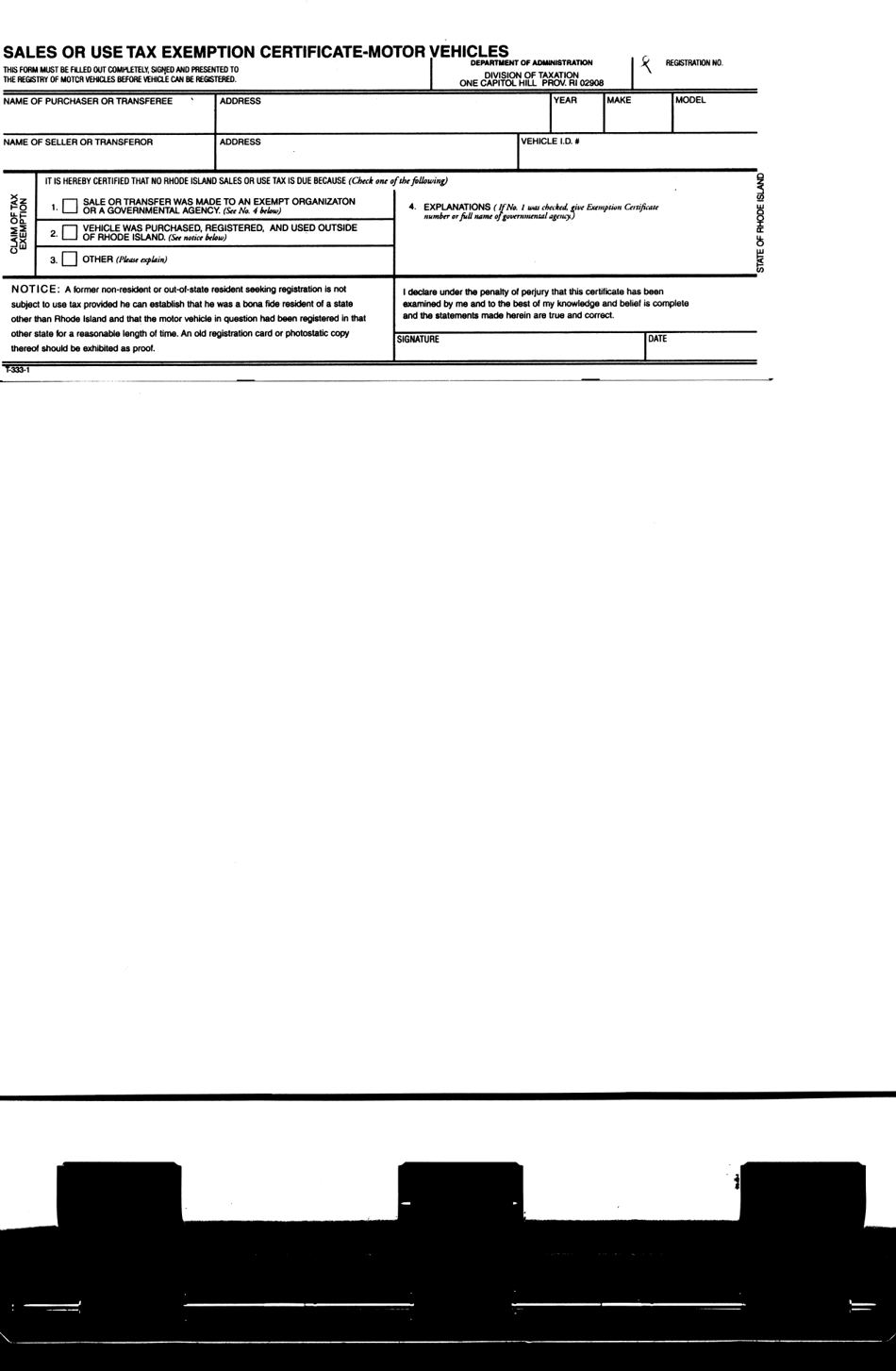

Form T3331 Fill Out, Sign Online and Download Printable PDF, Rhode

What Items Are Exempt From Sales Tax In Rhode Island Web what transactions are generally subject to sales tax in rhode island? How do i purchase my inventory of goods for resale without. Web what if i have customers that are exempt from paying sales tax? All tangible products within rhode island are taxable. Web what transactions are generally subject to sales tax in rhode island? To help you determine whether you need to collect sales tax in rhode island, start by. (b) effective october 1, 2012, the exemption from. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web the seller acts as a de facto collector. Web in rhode island, certain food items are exempt from sales tax. Web the human body are exempt from the rhode island sales and use tax. Web rhode island tax laws. This exemption includes most grocery items. The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions.

From www.softwaresuggest.com

GST Exemption A Detailed List Of Exempted Goods and Services What Items Are Exempt From Sales Tax In Rhode Island Web in rhode island, certain food items are exempt from sales tax. All tangible products within rhode island are taxable. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web the human body are exempt from the rhode island sales and use tax. Web what if i have customers that are exempt from paying. What Items Are Exempt From Sales Tax In Rhode Island.

From www.templateroller.com

Form EXOAPP Download Fillable PDF or Fill Online Sales &(use Exemption What Items Are Exempt From Sales Tax In Rhode Island Web the human body are exempt from the rhode island sales and use tax. Web in rhode island, certain food items are exempt from sales tax. The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web the seller acts. What Items Are Exempt From Sales Tax In Rhode Island.

From www.templateroller.com

Form STM Fill Out, Sign Online and Download Fillable PDF, Rhode What Items Are Exempt From Sales Tax In Rhode Island Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web in rhode island, certain food items are exempt from sales tax. (b) effective october 1, 2012, the exemption from. Web what transactions are generally subject to sales tax in rhode island? This exemption includes most grocery items. The passage of the fiscal year 2023. What Items Are Exempt From Sales Tax In Rhode Island.

From www.salestaxsolutions.us

Sales Tax Rhode Island Rhode Island Sales and Use Tax What Items Are Exempt From Sales Tax In Rhode Island Web the human body are exempt from the rhode island sales and use tax. This exemption includes most grocery items. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web what transactions are generally subject to sales tax in rhode island? Web in rhode island, certain food items are exempt from sales tax. How. What Items Are Exempt From Sales Tax In Rhode Island.

From www.formsbank.com

Application For Certificate Of Exemption For An Exempt Organization What Items Are Exempt From Sales Tax In Rhode Island Web the human body are exempt from the rhode island sales and use tax. Web what transactions are generally subject to sales tax in rhode island? (b) effective october 1, 2012, the exemption from. Web what if i have customers that are exempt from paying sales tax? The passage of the fiscal year 2023 budget has expanded rhode island’s sales. What Items Are Exempt From Sales Tax In Rhode Island.

From printableformsfree.com

Rhode Island Fillable Tax Forms Printable Forms Free Online What Items Are Exempt From Sales Tax In Rhode Island Web what transactions are generally subject to sales tax in rhode island? Web what if i have customers that are exempt from paying sales tax? Web the human body are exempt from the rhode island sales and use tax. Web rhode island tax laws. To help you determine whether you need to collect sales tax in rhode island, start by.. What Items Are Exempt From Sales Tax In Rhode Island.

From www.formsbank.com

Rhode Island Sales Tax Declaration printable pdf download What Items Are Exempt From Sales Tax In Rhode Island This exemption includes most grocery items. Web rhode island tax laws. Web the human body are exempt from the rhode island sales and use tax. The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web what transactions are generally. What Items Are Exempt From Sales Tax In Rhode Island.

From www.signnow.com

Rhode Island 1041 20202024 Form Fill Out and Sign Printable PDF What Items Are Exempt From Sales Tax In Rhode Island Web rhode island tax laws. Web what transactions are generally subject to sales tax in rhode island? This exemption includes most grocery items. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. How do i purchase my inventory of goods for resale without. (b) effective october 1, 2012, the exemption from. All tangible products. What Items Are Exempt From Sales Tax In Rhode Island.

From www.flipsnack.com

Sales Tax Exempt Letter Exp 03.31.2025 by amber Flipsnack What Items Are Exempt From Sales Tax In Rhode Island Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web the human body are exempt from the rhode island sales and use tax. Web the seller acts as a de facto collector. To help you determine whether you need to collect sales tax in rhode island, start by. Web what transactions are generally subject. What Items Are Exempt From Sales Tax In Rhode Island.

From www.formsbank.com

Fillable Form ExoApp Sales & Use Exemption For An Exempt What Items Are Exempt From Sales Tax In Rhode Island Web what if i have customers that are exempt from paying sales tax? Web in rhode island, certain food items are exempt from sales tax. This exemption includes most grocery items. The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. To help you determine whether you need to collect sales tax in rhode island,. What Items Are Exempt From Sales Tax In Rhode Island.

From www.templateroller.com

Form SUNR1 Download Printable PDF or Fill Online Rhode Island Sales What Items Are Exempt From Sales Tax In Rhode Island Web the human body are exempt from the rhode island sales and use tax. Web in rhode island, certain food items are exempt from sales tax. How do i purchase my inventory of goods for resale without. Web what transactions are generally subject to sales tax in rhode island? Web rhode island tax laws. All tangible products within rhode island. What Items Are Exempt From Sales Tax In Rhode Island.

From www.signnow.com

Ri 1040v Online 20222024 Form Fill Out and Sign Printable PDF What Items Are Exempt From Sales Tax In Rhode Island Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web the seller acts as a de facto collector. Web in rhode island, certain food items are exempt from sales tax. To help you determine whether you need to collect sales tax in rhode island, start by. Web what if i have customers that are. What Items Are Exempt From Sales Tax In Rhode Island.

From www.pdffiller.com

Fillable Online Rhode Island Tax Exempt Form Fax Email Print pdfFiller What Items Are Exempt From Sales Tax In Rhode Island To help you determine whether you need to collect sales tax in rhode island, start by. Web in rhode island, certain food items are exempt from sales tax. This exemption includes most grocery items. Web the seller acts as a de facto collector. The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. Web the. What Items Are Exempt From Sales Tax In Rhode Island.

From www.formsbank.com

Sales Tax Exemption List Form printable pdf download What Items Are Exempt From Sales Tax In Rhode Island Web what if i have customers that are exempt from paying sales tax? Web the human body are exempt from the rhode island sales and use tax. Web what transactions are generally subject to sales tax in rhode island? All tangible products within rhode island are taxable. Rhode island imposes a 7 percent sales tax on the sale of most. What Items Are Exempt From Sales Tax In Rhode Island.

From www.formsbank.com

Fillable Sales And Use Tax State Of Rhode Island printable pdf download What Items Are Exempt From Sales Tax In Rhode Island The passage of the fiscal year 2023 budget has expanded rhode island’s sales tax exemptions. Web in rhode island, certain food items are exempt from sales tax. Web the human body are exempt from the rhode island sales and use tax. (b) effective october 1, 2012, the exemption from. Web the seller acts as a de facto collector. This exemption. What Items Are Exempt From Sales Tax In Rhode Island.

From escapeinc.org

E.S.C.A.P.E. Inc. Rhode Island Sales and Use Tax Exemption issued 02/19 What Items Are Exempt From Sales Tax In Rhode Island Web what if i have customers that are exempt from paying sales tax? Web the seller acts as a de facto collector. Web rhode island tax laws. (b) effective october 1, 2012, the exemption from. All tangible products within rhode island are taxable. Web what transactions are generally subject to sales tax in rhode island? To help you determine whether. What Items Are Exempt From Sales Tax In Rhode Island.

From www.softwaresuggest.com

GST Exemption A Detailed List Of Exempted Goods and Services What Items Are Exempt From Sales Tax In Rhode Island Web what if i have customers that are exempt from paying sales tax? To help you determine whether you need to collect sales tax in rhode island, start by. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web rhode island tax laws. All tangible products within rhode island are taxable. Web the seller. What Items Are Exempt From Sales Tax In Rhode Island.

From calculator-online.info

Rhode Island Sales Tax Calculator State, County & Local Rates What Items Are Exempt From Sales Tax In Rhode Island Web the seller acts as a de facto collector. Web in rhode island, certain food items are exempt from sales tax. All tangible products within rhode island are taxable. Rhode island imposes a 7 percent sales tax on the sale of most tangible items. Web rhode island tax laws. The passage of the fiscal year 2023 budget has expanded rhode. What Items Are Exempt From Sales Tax In Rhode Island.